Alchemy in action at a family barbecue

Merriam Webster defines alchemy as "a power or process that changes or transforms something in a mysterious or impressive way." When you think about it this can apply to most anything, from a chemical reaction, to an emotional response, to a financial value. For example, I actually got to see alchemy occur in person on a Saturday night in late Spring. I have an 11-year-old and a 13-year-old, and we were having a barbecue. After we gorged ourselves on hot dogs and hamburgers, my eleven year old left half a hot dog on his plate.

My 13-year-old turns to my 11-year-old and says, "Are you going to eat that?"

I know that my 11-year-old did not care about that hot dog. She was just waiting to take it to the trash and throw it away. But the second my 13-year-old says “are you going to eat that,” my 11-year-old curled up around it and said, “Mine!”

All of a sudden that half a hot dog had value. It became an asset. A negotiation ensued. There were threats of violence, wrongs brought up since grade school, and eventually the value of that half of a hot dog turned out to be 30 minutes on the 13-year-old’s hoverboard. The negotiation worked out the value of that hot dog.

That's what I’d like to focus on here: creating and measuring the value of an asset. Let’s discuss measuring value, and how valuation comes from the art of measurement. It is possible to determine and transmute what is essentially not considered an asset into something of greater value: an asset. This is content alchemy in action.

Recognizing content as an actual, measurable asset

From a business perspective, content is not considered to be a durable asset and is viewed as worthless from a long-term perspective. What types of content am I talking about? Articles, editorials, whitepapers, video, podcasts, support content, marketing content, and other forms of organizational knowledge.

This also includes

metadata — the valuable information underlying our content that makes it more useful and portable. Much of this content will be produced and distributed across the internet on a daily basis. The thing is, it's not considered to be a durable asset, even though it sticks around and continues to produce value. For a lot of people from a traditional business background, it is considered to be worthless from a long-term perspective.

So what is an asset? From a purely financial standpoint, the types of content we are talking about are not currently considered to be durable assets. Content is seen as an expense instead.

FASB and the durable asset

So what is a durable asset? Let's take our definition from FASB, the Financial Accounting Standards Board:

Assets are probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events.

–FASB STATEMENT OF FINANCIAL ACCOUNTING CONCEPTS NO.6

FASB sees probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events. FASB also provides an even longer definition:

An asset has three essential characteristics: (a) it embodies a probable future benefit that involves a capacity, singly or in combinations with other assets, to contribute directly or indirectly to future net cash inflows, (b) a particular entity can obtain benefit and control others´ access to it, and (c) the transaction or other event giving rise to the entity's right to or control of the benefit has already occurred. Assets commonly have other features that help identify them-for example, assets may be acquired at a cost 19 and they may be tangible, exchangeable, or legally enforceable. However, those features are not essential characteristics of assets. The absence, by itself, is not sufficient to preclude an item´s qualifying as an asset. That is, assets may be acquired without cost, they may be intangible, and although not exchangeable they may be usable by the entity in producing or distributing other goods or services. Similarly, although the ability of an entity to obtain benefit from an asset and to control others´ access to it generally rests on a foundation of legal rights, legal enforceability of a claim to the benefit is not a prerequisite for a benefit to qualify as an asset if the entity has the ability to obtain and control the benefit in other ways.

–FASB STATEMENT OF FINANCIAL ACCOUNTING CONCEPTS NO.6

So, an asset is basically something that’s probably going to make money sometime in the future, either directly or indirectly. It generates economic benefit, also known as value. Whoever owns it gets the benefit, so it’s a thing. Content is a tangible or intangible thing over which you can exert ownership.

If you want to count something as an asset, you have to already own it. Financial folks, accounting folks, and business folks think about assets in those terms. Because corporations own the assets we produce, it makes sense that they have trouble seeing content as an asset based on how they understand it.

Assets we know and love

Let’s talk about some really common assets that everybody already recognizes:

- Machinery: When you buy a bulldozer and plow things around with it, you get value from that asset.

- Real estate and real property.

- Inventory and goods: If you buy a bunch of TVs and store them in a warehouse, at some point in the future you can sell them and make money.

- Software licenses: If you have thousand or millions of dollars in software licenses, you can derive a future economic benefit from them as well.

So, why is there a disconnect on valuing content as an asset? When we start thinking about why content isn’t treated as an asset, we have to look at how we treat our own content. We need to look at the purpose of the content and follow the money.

Classes of content

Let’s talk about three content classes and how they generate value. There are more classes, but we are going to focus on three, where the money is, and the intent behind each of these classes.

- Advertising: The advertising revenue model is what most media depends on today. Content is simply meant to deliver advertising to the audience. It’s like saying we deliver burrito wrappers. The burrito wrapper is the article that carries the burrito to the consumer.

- Marketing: In the marketing model, content is meant to produce a desired result by the audience. Through the entire process of journey mapping, etc., the audience ends up buying the product or service.

- Support: In the support model, we reduce customer effort and improve customer brand experience, retain customers, build word of mouth, and grow loyalty and share of wallet. Oftentimes, we generate value by avoiding inbound support calls or other cost-heavy support transactions.

Why content isn’t treated like an asset

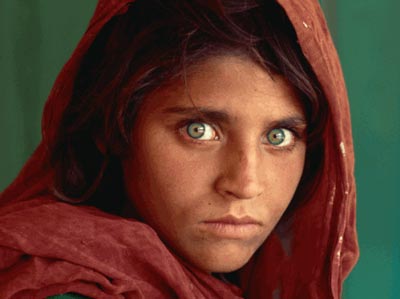

This iconic photo came from the June 1985 National Geographic magazine, and most of us have seen it many times since. For the purpose of this article, let's think about this photo as an asset.

When people bought the June 1985 edition of National Geographic, what did they do with it after they finished reading it? They put it down in the bookcase in the basement with all the other National Geographics. Would National Geographic make a single penny more if you picked this issue up in 1993 or 2017 and opened it up and read the same article? No, because it's print.

I can’t think of any other product whose format makes it suitable for little more than wrapping your fish, starting a fire, or being recycled the next day. The product and the delivery mechanisms for that type content have really finite lifespans.

Print content isn’t treated as an asset because of an outdated business model that's no longer applicable today. Accessing print content used to be really hard. Back then, everything once in print was stored in microfiche, and there's no additional revenue gained when viewing microfiche. But now, in the digital age, everything is different.

Organizations that recognize intangible content assets

Let's look at some other content that organizations are already treating as assets:

- Movies and TV shows: Sony has $82 billion on their balance sheet for their movie titles and Time Warner enjoys $7.6 billion for all the syndicated television shows.

- Music: Warner Brothers has $2.5 billion on their balance sheet for the music they own.

- Other intellectual property: Many corporations reflect IP and other intangible assets including patents, copyrights, literary works like books, broadcast rights, customer lists.

If we were looking at National Geographic, we would not see a number anywhere on their balance sheet of their assets. I would argue, however, that their assets are just as long-lived now, if not longer, than some of these other assets. No one wants to see a syndicated TV show from 1985, but we'll watch a battle of the animals on Nat Geo any day.

In the middle of the continuum, we have magazines like National Geographic. Over on the far other side are podcasts, video, and news. This is a golden era to be a journalist. It's electric. Today, you can view that National Geographic article from 1985 on their website. Unlike when it was just a print article, the article generates revenue for National Geographic every time it’s viewed. That old print article which was once fish paper is now a long-term, long-lived, durable asset. It has lasting value.

The content asset mindset change

That which is perceived as worthless is worthless. That half a hot dog I talked about was worthless until somebody said, “Are you going to eat that?” What we need to do as content marketers is find a way to

measure and quantify the value of content and change the mindset of the industry. By changing the mindset towards content, we will change behaviors as well.

From a financial standpoint, content is often treated as an expense rather than an investment. When you start seeing content as an asset, however, you also want to extract that value from it over the long term. All of a sudden you want to get every penny out of that content. Publications like the

New York Times and CNN are going to be harvesting value from their content in 10, 20 or even five years. That approach is important because it supports a unified content strategy and omnichannel content reuse.

CFOs love to capitalize expenses. It allows them to do a lot of really cool financial stuff that makes the expense and the assets smooth from an accounting perspective. But very few non-media companies capitalize content assets, even though they spend increasing amounts of money building those assets and rely more and more on those assets to drive customer acquisition, mindshare, revenue, and value.

If we can take our content creation costs and start capitalizing them, we can support even more investment. This applies to most all of us who produce and manage content for marketing, advertising, or who support our content creation costs. That's a big deal. What if content value producers had 25 percent more to work with next year? What could we do with that?

Content owners are actually undervalued

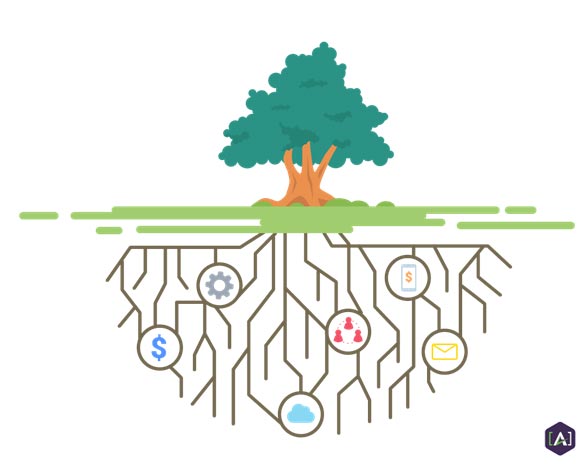

I do a lot of mergers and acquisitions for content companies. Typically, when you want to buy a content company, you ask for 20 and 12-month advertising revenue, subscription revenue, and any hard assets like real estate.

I also work a lot with newspapers. They used to have hard assets in real estate, but they don't anymore. It’s just based on ad revenue now. Nowhere, however, do we actually value the content assets of these companies, the stuff below the waterline. The result is that content companies are dramatically undervalued.

Imagine if Sony pictures didn’t have that $82.7 billion dollars on their balance sheet. It really wouldn't look that compelling. What does that mean for media and content companies who rely on content as assets? Content may be billed as an asset, but they usually have no way to leverage those assets.

Debt financing is often what keeps companies afloat. It's what they are able to do to manage their cash flow. They don't have that ability right now. What does it result in? It's great for people who buy content companies as a business asset when it's not being valued, but it's really bad for the sellers.

The content valuation solution

Content, just like any other asset, can be measured and valued. You just have to take an economics-based approach. This requires three things:

- Comparable data: The first thing is comparable data. You can't just make this stuff up. I can't just come in and say something “looks” like $10 million. I need to run this off of comparable data.

- Economics-based algorithm: Next, we need an economics-based algorithm. We have to have something that is able to take this empirical data and determine the long-term value at this moment in time so we can put it on our balance sheet.

- Third-party audit: Finally, we need an objective third party. If it’s going to be on your balance sheet, used in a negotiation, and you’re going to build your financials on your content, you need an objective third party to be able to make the determination.

Measuring the value of content assets

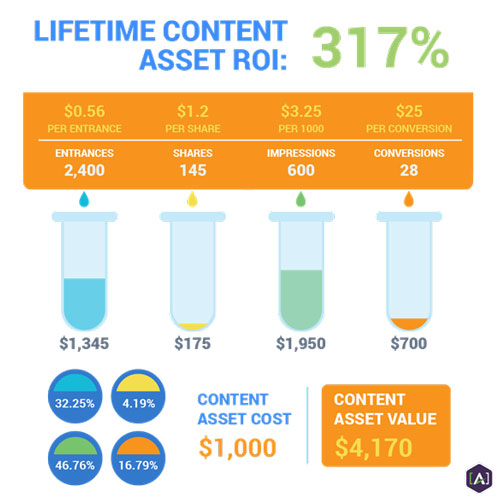

Let's talk about the empirical data aspect of content valuation. Nowadays, we can measure asset value because we have so much data about the interactions with our content; and, since content value comes from content interaction, that’s exactly where we start.

The very first way we evaluate content is by the number of new organic entrances to the property that we're evaluating. Specifically, we need to look at entrances generated by a particular

content asset. We know what we pay for that. We buy traffic on Facebook all the time, we look at it from a historical standpoint, and project this into the future.

A second measure is sharing. Social media sharing is really important for media companies these days since they get at least 60 percent of their traffic off of social media, most of on mobile devices. Now we know exactly what we'll pay for a share and we can see how it’s being deployed.

Finally, content is typically monetized around conversions. Somebody is doing something because they went to that piece of content, so we can determine what that's worth. In a media world, that's a sales commission. In a marketing communications or content marketing world, we know the value of direct conversions.

Empirical Data: a Multi-Stream Approach

After evaluating content and applying the cost of asset production data, we can eventually derive our ROI. Lifetime ROI is a product. We know what it costs. We know how much money it will probably make, has made, and will make in the future, so we can deliver an asset ROI.

Build towards a portfolio of content assets. If content is starting to feel like a stock, bond, or asset class, that's good. That’s where it really should be. We should be caring for, promoting, and distributing content like an asset.

So how do we do this?

Take the algorithm we talked about earlier, curve that, and backtest it against historical performance data. From there you can create a defensible projection and deliver it through a third party who can vouch for the process, the integrity, and the defensibility of your content. This type of “point-in-time” measurement is really critical if you're trying to value something that’s going to be bought or sold.

For content creators and managers, the way we derive that long-term value is through broad distribution, since

broad distribution equals broad value. Content looks like an expense when there's no reuse. It has a limited lifespan, limited distribution, limited impressions; but we still have all the costs that are associated with developing the content. For ephemeral content that doesn’t get reused, classifying it as an operating expense makes sense.

However, we could say that most content does have durable value. Whether it is something that is jammed out of somebody's word processor yesterday at 6 p.m. as the latest news about the president, or if it's something you spent two months working on, it has value if it’s reused.

With reuse and expanded distribution, content has much higher and longer lifespan, through versions, impressions, and distributions. What’s more, the costs don't go up with reuse.

When you layer these together, you see much more benefit without any potential incremental costs. This is how we extract that long-term value out of an asset that ideally is sitting on our balance sheets. Any content company that does not value its content is undervalued.

Make content matter

For accounting treatment, content producers can start making use of a lot of important financing options and accounting treatments. The shift to the balance sheet will change the way CEOs, CFOs, and boards value the production and management of vital content and metadata assets.

But in the end, what does this mean to you? Why should you care? One reason is budget. Whether you’re in a media company or a techcomm role, transforming content into an asset results in more budget being put towards content. Second is greater recognition. Once we start treating and calling our content assets, and people start to recognize our actions and our roles, our value as content producers increases.

When you’re in your meetings, working within your companies, or talking to your friends, start referring to your content as an asset. Start changing that perception. We are word people. We understand that words change perceptions.

[A] Content Value Discovery, Strategy, and Workshops

At [A]Ⓡ, we are moving this conversation forward with our clients in the form of content value discovery and strategy engagements, along with workshops, content analytics data warehouse development, and the early stages of content valuation modeling. If you would like to engage in any such discussion, please contact us.

Additional Resources

We would also like to point out the thought leadership provided by our friends at KlarisIP and their excellent work on the valuation of metadata. They have a remarkable related work titled "Classifying Metadata as Capital" that dives deep into exactly how metadata drives business value. You can download this article and the KlarisIP paper "Classifying Metadata as Capital" paired together here in [A] Guide to Content Valuation: A two-part guide to measuring content marketing ROI, content asset value, and the value of metadata. Additionally, check out these related [A] resources:

Contact Us for a Free Consultation.